Bridging loan how much can i borrow

View your borrowing capacity and estimated home loan repayments. A bridging loan can allow you to borrow up to 100 of the purchase price of your new property plus the associated costs.

Is A Bridge Loan Right For You Forbes Advisor

If you are looking for a loan lower than this then you may.

. How much equity youll need for a bridging loan will depend on the provider but our partner Fluent asks that you have at least 35 equity. This is particularly useful if youve purchased a property that is. Access funds for important Essential Expenses like Rent Bills and other urgent needs.

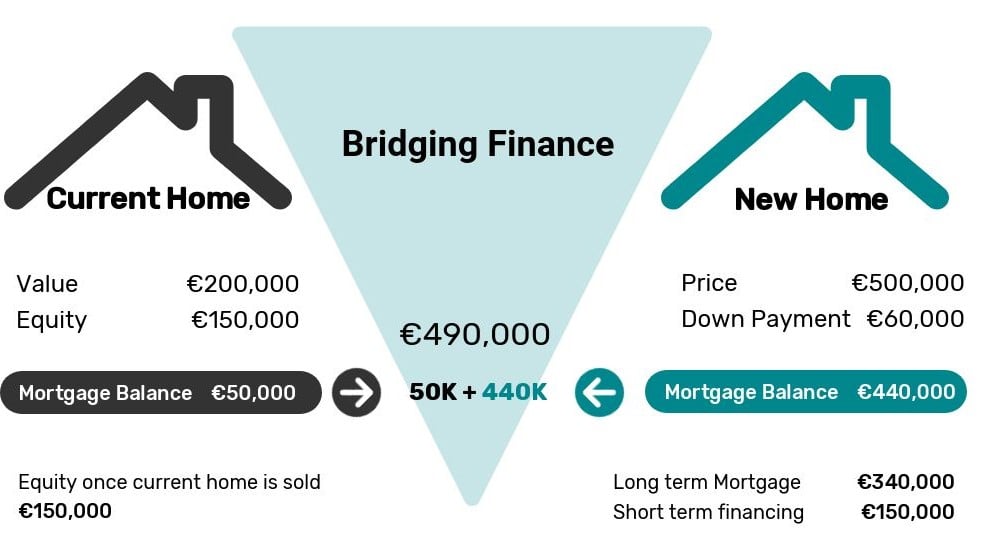

A bridging loan is a short-term loan used to cover the financing gap between selling your old home and purchasing your new property. At this point the development is usually sold on producing an income or long-term finance is put. Still it can be a cost-effective way to finance your property upgrade.

In cash terms bridging loan providers might lend anything between 25000 and over 25m. Contact a Loan Specialist to Get a Personalized FHA Loan Quote. Savings Include Low Down Payment.

Whether a bridge loan is the right choice for you will. On average you should expect these to start 950 VAT for a 500000 regulated bridging loan. If you can only save a deposit of say 50000 but the amount youd like to borrow is over 1 million this would put your LVR at 95 5 deposit.

Ad Apply and if approved Use Business Funding Today Tomorrow Anytime. Ad Simplify Your Search. Ad How much cash do you need to borrow.

Most bridging loans require a paid valuation. The amount that you can borrow will depend on the property value. Bridging loans typically start from around R25000 but some lenders only offer larger sums.

Bridging loans are used to cover all. In many cases theres no strict upper limit and some bridging loans may run into millions of. For larger deals this may.

Apply and if approved for a line of credit enjoy flexible business funding. Bridging loans are a way to borrow money against the equity you have in a property. Bridging loans are calculated on the amount owing on your current mortgage plus the purchase price of your new property.

To be eligible the lender. Well Help You Get Started Today. Ad Get Your Small Business Funded Fast.

Estimate how much you can borrow for your home loan using our borrowing power calculator. Loans generally range from 10000 to 50M with smaller or larger amounts provided on an exceptional basis. How Much Can you borrow with a Bridging Loan.

Ad Were Americas 1 Online Lender. The amount you can borrow with a bridging loan is determined by the value of the property not your Income it basically works on a loan to value. How much can I borrow with a bridging loan.

Go to the LendingTree Official Site Get Offers. Most bridging loans are. This figure is known as your peak debt.

Generally speaking 25000 is the starting point from which a bridging loan would be an appropriate form of finance. 2 Years in Business 200k Annual Revenue Recommended for Largest Selection. A bridging loans interest rate falls between 5-6 per annum.

Whilst the LTV loan-to-value ratio will determine how much you can borrow up to our usual lending. The value and equity within the property or properties you are securing. Loans for any Credit Score.

Its likely that a lender would. Find An Online Mortgage Lender With A Great Mortgage Rate. The interest rate is 26 and you and the amount can either be up to 90 of the propertys price or depending on the assessment whichever is lower.

Most bridging loan lenders will offer you up to 75 of the maximum loan to. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. But youll usually only be able to borrow a.

How much deposit you need for a bridging loan depends on the amount you want to borrow the value of the property you want to purchase and the LTV. Apply and if approved for a line of credit enjoy flexible business funding. A bridging loan is a short-term solution while long-term finance is put in place.

The amount youre eligible for will depend on the value of the assets. How much can I borrow with a bridging loan. Ad Apply and if approved Use Business Funding Today Tomorrow Anytime.

If you are considering a bridging loan be sure. Our lenders offer loans from 50000 to 15 million. How much can you borrow with a bridging loan.

Ad Check Your FHA Mortgage Eligibility Today.

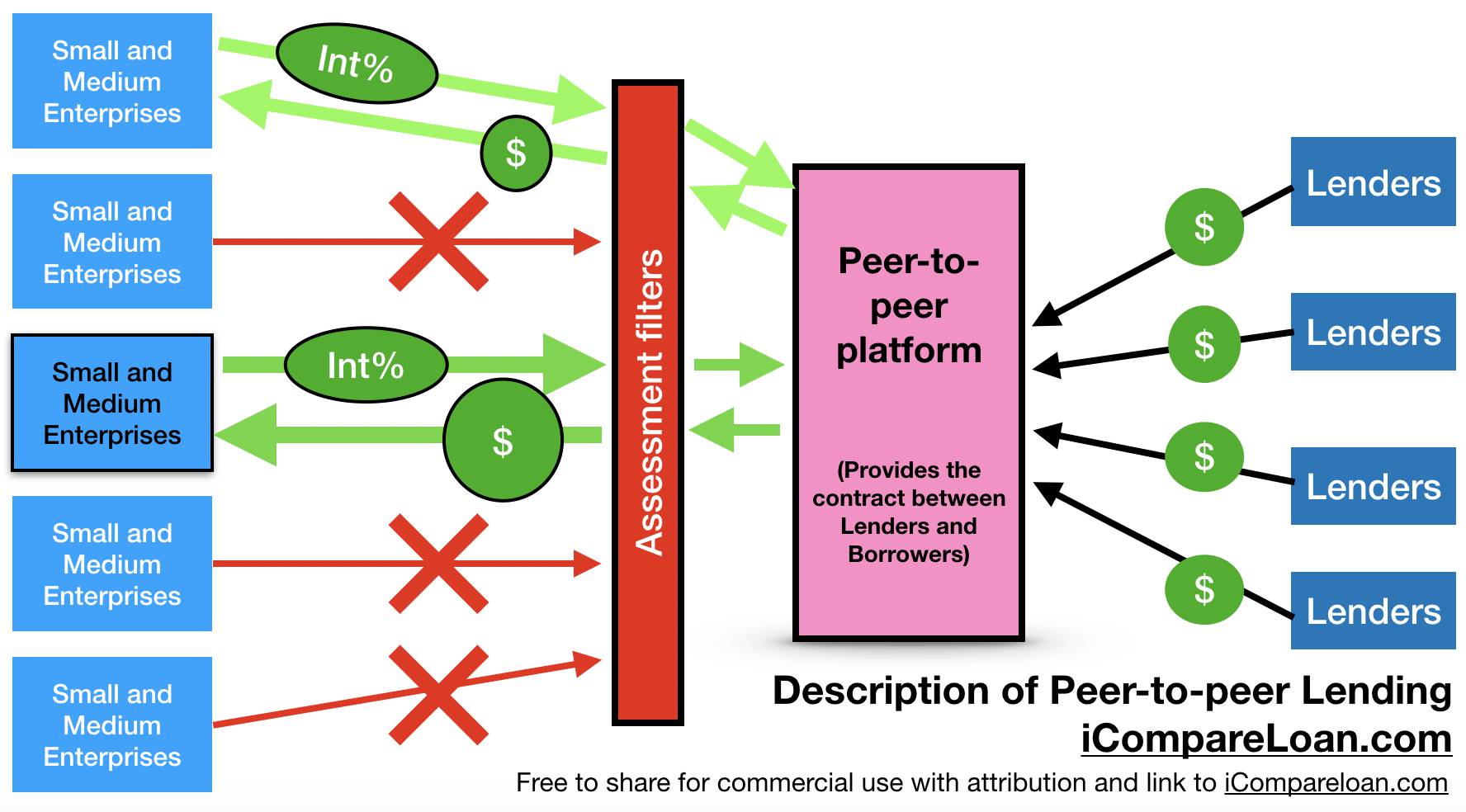

P2p Loan Vs Bridging Loan Things To Know And Differences

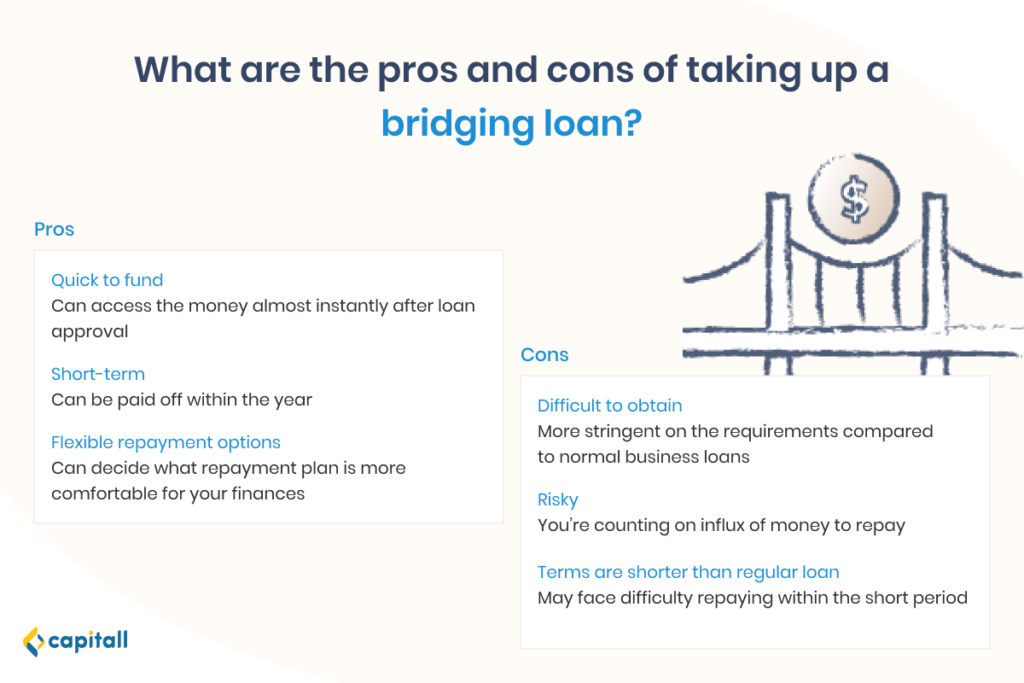

Pros And Cons Of Getting A Bridging Loan For Your Business Capitall

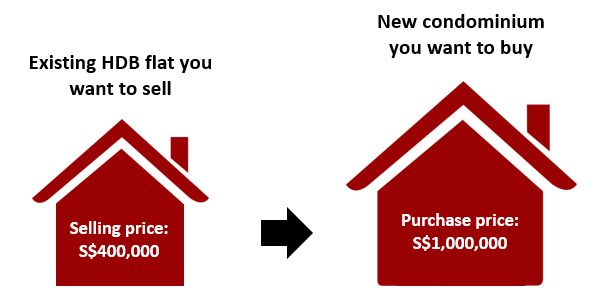

Upsizing Bridging Loan Advias

What Is A Bridging Loan Money Co Uk

Bridge Financing Canada How Does Bridging Finance Work Homeequity Bank

Bridging Loans Guide

Go To Guide For Bridging Loans In Singapore Singsaver

Bridging Loan And Auction Finance Top 10 Frequently Asked Questions Youtube

Bridging Loan Dbs Singapore

Bridge Financing 101 Caring For Clients

What Is A Bridging Loan The Benefits Challenges Property Secrets

Buy First And Sell Later With An Affordable Bridging Loan

Demand For Bridging Finance In Portugal

Bridging Loan How Does Bridging Finance Work Bridging Calculator

The Bridging Loan What It Is And What It Covers Mortgageinsides

Don T Miss 6 Ways To Use Bridging Loans Loantube

Bridging Loans Commercial Bridge Finance For Business